It was a year in which categories that haven’t changed much in decades (milk, water) evolved. When manufacturers of stalwart products that have hurt recently (beer, soda) did something about it. When categories that seemingly have always just been there (water, iced tea) could no longer be ignored.

“In general, most niche categories are growing, while traditional mass-market categories are struggling,” says Gary Hemphill, managing director of research for Beverage Marketing Corp. (BMC), New York.

For retailers, it was a year of revisiting just how varied their cold-vault shelves were and making hard decisions about which products deserve prime space.

But as you’ll discover in the following pages, c-store operators have a lot to cheer about in the beverage category.

Table of Contents

Bottled Water: Bubbles on the Boil

CSDs: Taking the Long View

Alcohol: Beer, Wine & Spirits

Energy Drinks: On Shaky Ground?

More: Milk, Iced Tea & Milk

Exclusive Consumer Shopping-Habit Study

Bottled Water: Bubbles on the Boil

It’s tempting to say convenience retailers should follow the bubbles. As much as marketers are avoiding the term “carbonated” these days, the fact is volume sales of carbonated waters—sparkling, seltzer and mineral—grew a phenomenal 17.2% during the 52-week period ending Nov. 1, according to IRI, Chicago.

Although it’s building from a relatively small base, “sparkling water is a star growth segment in bottled water,” says Hemphill.

In a world in which “better for you” is the trend, sparkling water is riding a halo of good intentions.

“Some consumers who are consuming fewer carbonated soft drinks may be opting for sparkling water as what they perceive to be a healthier option,” Beverage Marketing Corp. managing director Gary Hemphill says.

But the truth is, sparkling water is just one shining element of this rejuvenated yearning for the original beverage. Volume sales of bottled water of all kinds grew 9.9% in c-stores in 2015, 9.4% for single-serve still waters and 10.3% for bulk water (jug and multipack).

It’s all part of the overriding sales trajectory that will drive bottled water to outsell CSDs in all retail channels by the end of this year—a direction it’s been heading for years. Bottled water last year outsold CSDs in supermarkets, according to Nielsen. In all channels, water is projected to have sold 11.7 billion gallons in 2015, compared to CSDs’ 12.6 billion, according to BMC. It’s expected to sell 14.5 billion gallons in 2020, and 848 million gallons in c-stores in 2019, according to Nestlé Waters North America, citing Nielsen estimates.

In the years in which bottled-water sales growth slowed—What!? Only 3.4% growth in 2013?—industry watchers suggested consumers were getting bored with water, that they needed something more.

Not to worry: Beverage manufacturers and entrepreneurs latched onto flavors, enhancements such as electrolytes, alkalinity, minerals and even protein, and of course bubbles to bring excitement to the category.

“Consumers want to have new and different flavors and use experiences,” says consultant Bill Jachthuber of WRJ Brand Marketing, Atlanta. “The overall consumer has expanded their want for variety, functionality and refreshment. This change has translated to many new entries in teas, waters and juice products, while the traditional CSDs have been trying to work on packaging, serving size and programming.”

That’s how Sparkling Ice, one of the major success stories in sparkling water, got in on the ground floor of the water boom. “We wanted to bring a beverage that’s low in calories, but we didn’t want to give up on taste,” says Kevin Klock, CEO of Sparkling Ice manufacturer Talking Rain, Seattle.

The opportunity for retailers, suggests Mike Joyce, vice president of marketing for Ionic Sportwater, Stamford, Conn., is to sell two bottles of water instead of one.

“It’s not just more water, but different waters,” he says. “I want the person to buy the $5 pack of Poland Spring [to drink every day] and also buy a functional water” to drink after a workout.

In convenience stores, where CSDs still outsell bottled waters by more than two to one in both volume and dollar sales, the status quo will likely stand for several more years. But the trend suggests bottled water still has a long way to grow in the c-store channel.

“We think water is still underdeveloped in a major way,” says John Zupo, president of customer development for the largest water company in the country, Nestlé Waters North America, Stamford, Conn. “It’s just the beginning.”

Continued: Carbonated Soft Drinks

CSDs: Taking the Long View

Carbonated soft drinks saw a bit of growth in 2015, up 1.6% in volume sales in c-stores for the 52 weeks ending Nov. 1, according to IRI scan data. After three years of declines, small growth is welcome—though some retailers are skeptical.

“If you’re seeing growth in CSDs, I’d like to know where it’s happening,” said one c-store retailer who asked not to be identified.

The c-store data runs counter to sales trends in all other retail channels, according to Gary Hemphill of Beverage Marketing Corp.

“Carbonated soft drinks are declining for the 11th consecutive year, with more declines likely ahead,” he says.

The improvement in c-store sales has been driven by flavored CSDs—Mountain Dew, Dr Pepper and a collection of lemon-lime sodas, among others—while colas continue to feel pressure.

“The category continues to soften” is how analyst Vivien Azer of Cowen & Co., Chicago, puts it, and it’s showing in how the major soda-makers go to market.

Leaders from both PepsiCo and The Coca-Cola Co. have expressed their desires to be thought of as well-rounded beverage companies, while Dr Pepper Snapple Group (DPSG) is relying on its “allied brands” strategy—distribution partnerships with smaller, independent (usually noncarbonated) beverage brands—to maintain year-over-year growth.

“We’ve got a lot of runway left for distribution availability,” says Larry Young, president and CEO of DPSG, Plano, Texas.

However, these companies wisely remain committed to growing their CSD portfolios, still the largest piece of c-stores’ beverage-sales pie, while also watching for opportunities in other beverage types.

“Focusing just on CSDs is a thing of the past,” said Indra Nooyi, CEO of Purchase, N.Y.-based PepsiCo, during an earnings call in October. “In a marketplace that’s shifting more toward [noncarbonated beverages], we’ve got to make sure that we step up our investment in noncarbs, our innovation in noncarbs.”

Muhtar Kent, CEO of Atlanta-based Coca-Cola, generally agreed.

“A mix is really working for us,” he said during Coca-Cola’s earnings call in October. “[It] is generating positive results for us in terms of the revenue growth, purely from sparkling, as well as from the still side of the business.”

Nooyi is also quick to defend CSD sales.

“There’s been a small share loss,” Nooyi said of Pepsi-Cola, “but if you look across the portfolio, Mountain Dew is doing exceedingly well, we’re doing very well in small format, and we’ve really been working the portfolio to make sure that channel management, price-pack management, trade management, innovation management and overall portfolio management works to deliver overall LRB (liquid refreshment beverages) share increase.”

Her bottom-line message?

“I would strongly suggest everyone look at total LRB because that’s the right way to look at the market going forward,” Nooyi says.

Leading CSDs

After cola, the best-selling flavors of carbonated soft drinks in convenience stores are citrus, led by Mountain Dew, and Dr Pepper’s “pepper.” Here are the largest-selling CSD SKUs and largest dollar share of flavored CSDs:

CSD SKUs in Dollar Sales

| Product | Sale in millions |

| Mountain Dew (20-ounce) | $728 |

| Coca-Cola (20-ounce) | $553 |

| Dr Pepper (20-ounce) | $367 |

| Pepsi (20-ounce) | $344 |

| Diet Coke (20-ounce) | $252 |

Flavors’ Dollar Share of Sales

| Flavor | Share |

| Citrus | 47.7% |

| Pepper | 19.5% |

| Lemon lime | 13.4% |

| Orange | 4.7% |

| Ginger ale | 3.9% |

| Root beer | 3.1% |

| Other flavors | 7.9% |

Source: Nielsen, 52 weeks ending Oct. 10, 2015

Alcohol: Beer's Year of Transition/Good News About Booze

The year in beer looked unlike any other.

On the domestic front, Anheuser-Busch and MillerCoors continued to scoop up regionally known craft brewers—including Saint Archer for Chicago-based MillerCoors, and Breckenridge, Four Peaks and 10 Barrel (among others) for St. Louis-based A-B—while Pabst Brewing launched both craft and import divisions. Even importer Constellation Brands got into the game, acquiring San Diego-based Ballast Point Brewing & Spirits and partnering with celebrity chef Rick Bayless to create a line of craft beers inspired by traditional Mexican ingredients.

Meanwhile, Heineken USA trimmed its portfolio by discontinuing tequila-flavored beer Desperados to focus on its core brands: Heineken, Dos Equis, Strongbow and Tecate. It also joined Constellation Brands in basking in a south-of-the-border glow as Mexican imports Dos Equis (16%), Corona Extra (14%) and Modelo Especial (24%) all grew c-store volume by double digits, according to IRI data.

Overall, import beers grew volume sales in c-stores by 14%, joining craft (26%) and cider (30%) as the big winners for the category as younger legal-aged drinkers entered the category with a more complex palate and a desire to set their own trends.

One other unexpected trend—almost single-handedly driven by the remarkable growth of the craft beer Not Your Father’s Root Beer—had U.S. brewers learning the ropes of hard soda. The result: A-B launched Best Damn Root Beer in December; MillerCoors developed the Henry’s Hard Soda brand, which launched in January; and Pabst partnered with the prodigal Not Your Father’s maker Small Town Brewery.

On top of all of the above, one of the largest consumer-product acquisition deals ever looms as the largest brewer in the world, A-B parent Anheuser-Busch InBev, wades through the regulatory swamp in its effort to purchase No. 2 brewer SABMiller, majority partner in MillerCoors.

Admittedly not a U.S. play (an already-strong U.S. presence and regulatory concerns assured that), the approximately $107 billion deal will create the fifth-largest consumer-products company in the world.

The real news here is what it won’t include: Molson Coors, the other half of MillerCoors, is in line to take over all of the partnership’s brands in the United States to the tune of $12 billion. Milwaukee may never be the same.

Where Was Beer’s Growth in 2015?

Cider exploded in 2014, growing an amazing 131% in case sales in convenience stores. A year later, cider continues to be the fastest-growing subcategory of beer, but at a more moderate rate of 30%, according to IRI data, as other sweet beers—the apple ales and hard root beers of the world—grab more attention.

| Subcategory | 2015 case sales (in millions) | PCYA* |

| Cider | 3.6 | +30.1% |

| Craft | 20.1 | +25.5% |

| Import | 80.1 | +13.9% |

| Nonalcohol | 0.5 | +11.0% |

| Domestic super premium | 51.1 | +9.6% |

| Progressive adult beverages | 28.5 | +1.3% |

| Domestic premium | 405.1 | +1.0% |

| Domestic malt liquor | 23.2 | +0.6% |

| Domestic subpremium | 194.9 | (3.4%) |

* Percent change from a year ago | Source: IRI; 52 weeks ending Nov. 1, 2015

Good News About Booze

As the beer category continues to shift and churn, the unexpected rise of Fireball Whisky has fueled a rise in whiskey culture that goes far beyond Kentucky.

“Whiskey has become the drink of choice for millennials for a number of reasons: the resurgence of the cocktail culture, the rise in popularity of craft distilleries and locally produced spirits,” Drake Lucas, who runs the blog Whiskey Goddess, told the New York Post recently.

More than that, millennials—and Generation Z behind them—are jumping into wine and beer much earlier than previous generations did. “Millennials did something no previous generation had done: They didn’t just drink beer” when they hit drinking age, says Donna Hood Crecca, senior director of Technomic, Chicago. “Millennials have had a dramatic impact on the alcohol market.”

That impact is reflected in IRI’s c-store scan data, which shows volume growth in beer (+2%), wine (+7%) and spirits (+14%).

The winners in spirits are led by Smirnoff Vodka, along with whiskey purveyors Crown Royal and Jack Daniels. In fourth place, with a remarkable 86% volume growth during the 52 weeks ending Nov. 1, 2015, is Fireball, the little brand founded in the 1980s that blew up through social media and word of mouth.

Sparkling wine/champagne saw 9% volume growth during the same time period, with double-digit growth in seven of the top 10 best-selling brands in c-stores.

Energy Drinks: On Shaky Ground?

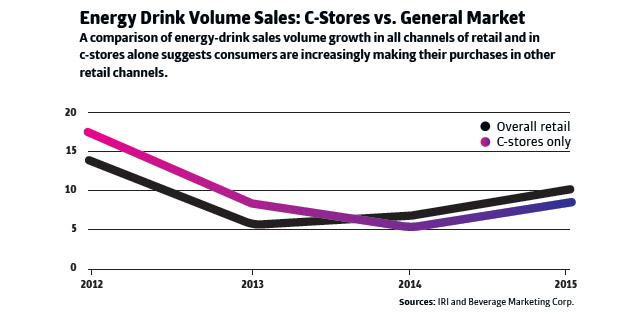

The energy-drink category began to get its groove back in 2015, but did it come at the expense of convenience stores?

Both IRI and BMC report better multichannel volume growth for the category than in the previous two years. The twist, however, is that BMC shows greater growth for the category in all channels of retail (10.1%) than IRI shows specifically in c-stores (8.5%).

Perhaps one reason is manufacturers’ efforts to target new demographics—consumers over age 30 who are more likely to stock up in grocery or mass retail stores.

The good news is that better growth is expected for the category overall, as Monster—now fully under Coca-Cola’s roof—and Red Bull duke it out for the No. 1 share position and Rockstar continues its recent trend of double-digit (more than 20%) dollar sales growth.

“Expectations [for Monster in c-stores] are higher based on retail price increases, [even as] Red Bull generally continues to outperform,” analyst Bonnie Herzog of New York-based Wells Fargo Securities said in a recent note.

Continued: Milk, Iced Tea & Milk

Milk, Iced Tea & Sports Drinks

Much like that of your cold-vault set, sports drinks, ready-to-drink tea and coffee, and milk will get much less space in this report than they probably deserve.

Regular milk—skim/low-fat and whole—continues to wane in c-stores, with unit sales down 8.7% and 1.9%, respectively, according to IRI data.

Meanwhile, sports drinks and coffee/tea are the unsung heroes of the cooler: Canned and bottled tea is up 6.6% in unit sales, cappuccino/iced coffee is up a healthy 16.0%, and sports drinks grew 8.1%.

A few trends are driving each segment:

Milk

Several factors are working in milk’s favor right now. New formulations from Coca-Cola’s fairlife and Dean Foods (Dairy Pure) are improving nutrition and adding to product shelf life, creating a subsegment of premium milk that should help grow dollar sales. MilkPEP, a Washington, D.C.-based group funded by the nation’s milk processors that is committed to increasing fluid-milk consumption, welcomed the new year with promotional program My Morning Protein. It’s an effort to emphasize the importance of getting 25 to 30 grams of protein before noon—with the help, of course, of milk.

Coffee/Tea

Packaged coffees and teas have become popular alternatives (after bottled water and energy drinks) for consumers moving away from carbonated soft drinks. This has led to numerous flavor variations and hybrid concoctions, including Java Monster (iced coffee with amped-up caffeine) and Lipton Sparkling Iced Tea (tea plus carbonation). The benefits for retailers: not losing that beverage customer, as well as a higher basket ring.

Sports Drinks

Sports drinks’ comeback appeared to be complete in 2015. After two years of ebbing sales growth, including a 2.5% volume decline in 2013, the category turned around in 2014 (up 4.7%) and topped 8% volume growth last year, according to IRI.

The growth has come on multiple levels as PepsiCo’s Gatorade products saw 8.8% growth, Coca-Cola’s Powerade moved back into the growth column, up 3.6%, and relative newcomer BodyArmor nearly tripled volume sales in c-stores (up 181.6%) to become a strong No. 3 brand in the category, surpassing private-label drinks, which grew sales 10.5%.

Top 5 Beverage Stories of 2015

Bottled Water to Overtake CSDs as No. 1 Packaged Beverage

This prediction has been a long time coming, with 2016 expected to be the tipping point.

AB InBev Buys SABMiller

Forget David and Goliath. In this case, two goliaths will combine to become one of the largest consumer-products companies in the world.

Coca-Cola Takes Control of Monster Energy

With this deal, Coca-Cola fully embraced that its strength in product development is not only what products it can create but also whom the company can buy.

Keurig Kold Launches

To date, SodaStream has owned the home-brewing soda market. Keurig aims to change that, while possibly changing the beverage industry entirely.

Pepsi Reformulates Diet Pepsi with Sucralose

Just as regular CSDs became the poster children for obesity in the United States, diet sodas sweetened with aspartame took a beating for allegedly causing cancer and still making consumers fat. Pepsi took itself to task by reformulating its Diet Pepsi by sweetening it with sucralose.

Continued: What Consumers Want

Dramatic Drinks

This past year, PepsiCo made Pepsi Perfect--a fictional soda featured in the 1989 movie “Back to the Future II”—into a limited-run reality. Over the years, numerous fictional sodas and beers (Shotz or Duff, anyone?) have made their way onto the small screen. In this day of diversification, here are some new types of beverages fantasized about in Hollywood scripts.

Tiger Thrust

Type: Energy drink

First appearance: 2016

Product of: “Cooper Barrett’s Guide to Surviving Life” (Fox)

A functional ingredient of this fictional energy drink? “The primary chemical in glow sticks.”

Piggy Water

Piggy Water

Type: Bottled water

First appearance: 2015

Product of: “The Muppet Show” (ABC)

Miss Piggy hawks this “buttery good” bottled water that contains 30 grams of fat per serving, and “when you open it up, it has lipstick on the rim, as if I took a sip of your water.”

Jumbo Jim’s Grape Scotch

Type: Flavored liquor

First appearance: 2010

Product of: “How I Met Your Mother” (CBS)

Influenced by trendy Fireball Cinnamon Whisky, HIMYM created its own sweet-but-strong libation. “Don’t let it touch your skin!” a waitress warns.

Exclusive Consumer Shopping-Habit Study

Location, location, location: It’s frequently cited as the key in real estate. Now an exclusive CSP/GasBuddy consumer survey suggests location is just as important to packaged-beverage sales.

Of the nearly 14,000 consumers—all of them GasBuddy fuel-price-app users—that took part in the survey, 24% said location is the most significant factor in choosing “a particular gas station/convenience store for a beverage purchase.”

Let’s take a look at how the decision process plays out:

Members help make our journalism possible. Become a CSP member today and unlock exclusive benefits, including unlimited access to all of our content. Sign up here.