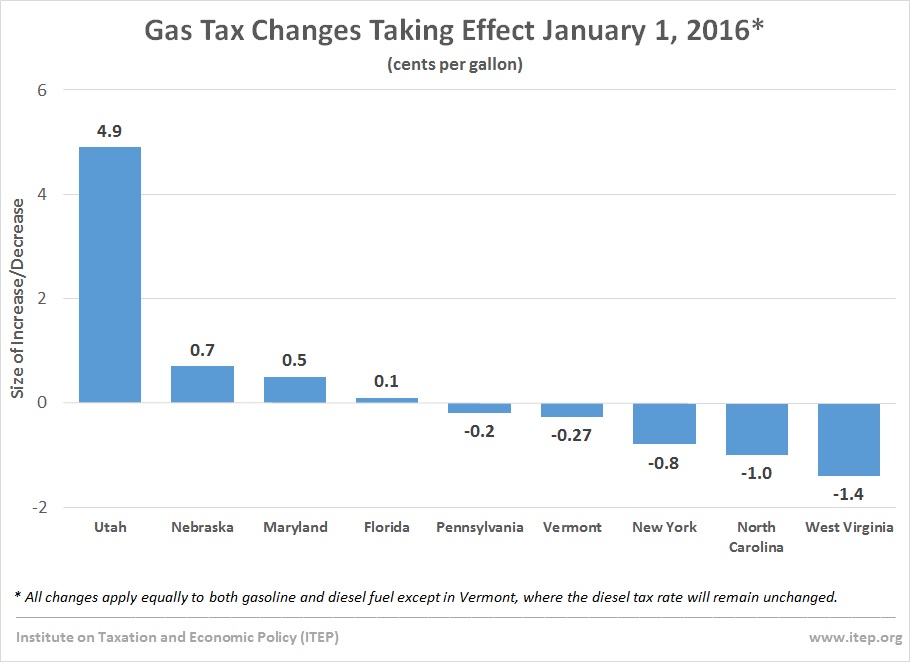

WASHINGTON -- Four states increased gasoline taxes at the start of 2016, while five actually lowered them. That’s according to an analysis by The Institute on Taxation & Economic Policy (ITEP), a nonpartisan, Washington-based research organization that focuses on local tax-policy issues.

The four states that increased their gasoline tax on Jan. 1 are Florida, Maryland, Nebraska and Utah. These changes ranged from a 0.1-cent-per-gallon (CPG) increase in Florida, where the state gas tax is linked to the Consumer Price Index, to a 4.9-CPG increase in Utah. For Utah, this is the first of potentially more increases that could push the gas tax up to 15.5 CPG, based on future inflation rates and gas prices.

Maryland implemented a 0.5-CPG increase after increasing its rate from 3% to 4%. It was triggered by a stipulation in 2013 transportation funding bill that required the state to increase the gas tax as a source of funding, if the United States Congress failed to pass legislation that would give states the power to collect sales taxes on Internet transactions. An additional 1-percentage-point increase will trigger on July 1 if the Web-based sales tax issue is not resolved by Congress.

In Nebraska, the state legislature passed a new law that increased the gas tax by 0.7 CPG. It is set to increase 1.5 CPG at the start of each of the next four years. Legislators overrode a veto by Governor Pete Ricketts to pass the increase. This year’s bump was cut by more than half because a separate provision ties the rate to gas prices, which have been falling.

Later for 2016, Washington’s gas tax is set to rise July 1. Meanwhile, legislators in Alabama and Missouri are considering whether to increase their state gas taxes in upcoming legislative sessions.

The five states that dropped gas tax rates in 2016 are New York, North Carolina, Pennsylvania, Vermont and West Virginia. West Virginia saw the biggest decline at 1.4 CPG, followed by North Carolina (1 CPG), New York (0.8 CPG), Vermont (0.27 CPG) and Pennsylvania (0.2 CPG). West Virginia, New York and Vermont’s gas tax rate structures are connected to the average price of gasoline, similar to a traditional sales tax.

Pennsylvania’s tax rate cut for 2016 was actually preceded and will be followed by rate increases, including one in 2017.

Legislators in North Carolina stepped in last year to minimize the decrease in the gas tax originally set to take place, to protect infrastructure funding. The state has since unlinked its gas tax rate from gas prices and tied it to the rate of population growth and energy prices. Other states, including Georgia, Kentucky and North Carolina, also acted last year to minimize scheduled cuts to protect infrastructure funding.

ITEP recommends linking gas tax rates to a measure of growth, such as gas prices, inflation or fuel-efficiency, but in a way that minimizes volatility. Since 2013, 18 states have enacted laws to increase or reform their gas taxes, according to the research group. This includes imposing a “floor” on the minimum gas tax rate, limiting how much the rate can change, or adopting more stable measures of inflation.

Members help make our journalism possible. Become a CSP member today and unlock exclusive benefits, including unlimited access to all of our content. Sign up here.